- #2016 TAX EXTENSION FORM PRINTABLE PDF#

- #2016 TAX EXTENSION FORM PRINTABLE PLUS#

The current tax year is 2021, and most states will release updated tax forms between January and April of 2022.

Generally, a domestic partnership must file Form 1065 by the 15th day of the 4th month following the date its tax year ended as shown at the top of Form 1065. Montana has a state income tax that ranges between 1 and 6.9, which is administered by the Montana Department of Revenue.TaxFormFinder provides printable PDF copies of 79 current Montana income tax forms. If that is an LLC with SEVERAL members - it would be classified as a partnership - and form 1065 is needed. In addition to Form 1065, partnerships must also submit Schedule K-1, a document prepared for each partner.

Return of Partnership Income, is a tax document used to declare the profits, losses, deductions, and credits of a business partnership. March 15 is also the due date for individual partners to receive Schedules K-1 showing their shares of the partnership's income or loss.

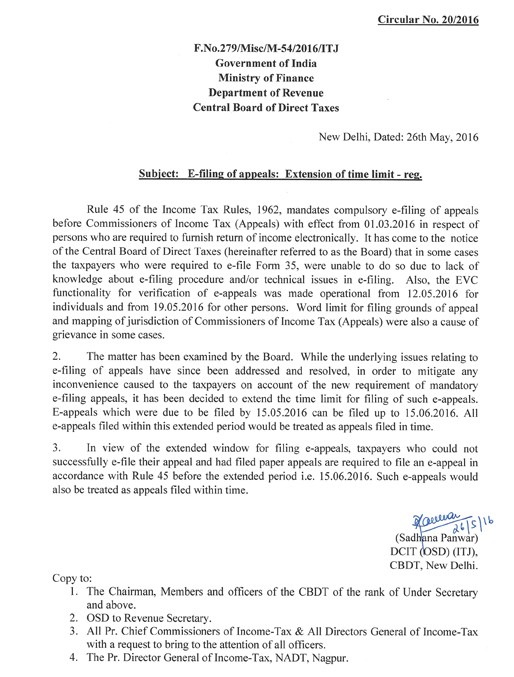

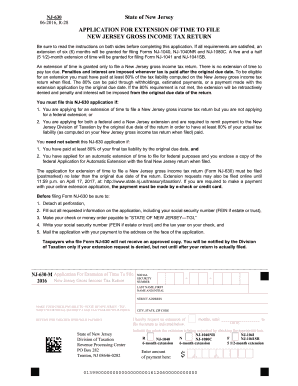

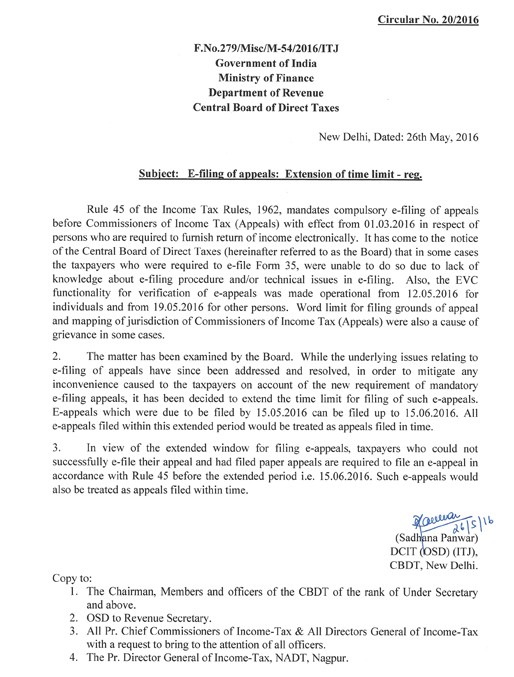

› Health Benefits Plus Anthem Bcbs Otc Catalogįrequently Asked Questions When are 1065 returns due?įorm 1065 is due on the 15th day of the third month after the end of the partnership's tax year, so the partnership return due date is normally March 15 for a December 31 year-end. Extension of Time To File Your Tax Return.  About Form 4868, Application for Automatic Extension of Time to File U.S. Just watch your mail to ensure that the IRS has accepted your application. Then, you can file your federal income tax forms at any time prior to the end of the 6 month extension. (Youll still owe interest if you pay after the deadline). Keep in mind: An extension doesnt give you extra time to pay your taxes but it will keep you from getting a late filing penalty. Personal Tax Extension Form 4868 is for individual or joint taxpayers to apply for an additional 6 months to file IRS Form 1040, 1040A, 1040-EZ, 1040NR, 1040NR-EZ, 1040-PR or 1040-SS. It isnt possible to file a post-deadline extension. Tax Extension for personal income tax can be applied using Form 4868. If you know that you owe money to the IRS and can reasonably estimate how much you owe, you can avoid both the late payment penalty and late filing penalty by submitting Form 4868 and include a payment. IRS extensions for tax year 2021 must be filed on or before Apfor domestic taxpayers. Should I File Form 4868 Or Use The Automatic 2 Month Extension?Īs you read through the Form 4868 instructions, you may realize that it is easier to print, fill out, write a check, and mail in Form 4868 versus trying to figure out if you meet the automatic 2 month extension test.įurthermore there are two penalties involved here: Using the normal tax due date of April 15, the total time allowed to file your income tax return would be October 15. If you are out of the country, for example, and submit Form 4868, you may be applying for an additional 4 months. The phrase 6 more months is used to reconcile the fact that US citizens and resident aliens abroad are often given an automatic 2 months extension. How Long Is The Extension Using Form 4868?įorm 4868 is an application for an extension of time to file for 6 more months. You can use Form 4868 to request an extension of time to file the following forms:ġ040-SS. Form 4868 Is Used To Extend Which Income Tax Forms?

About Form 4868, Application for Automatic Extension of Time to File U.S. Just watch your mail to ensure that the IRS has accepted your application. Then, you can file your federal income tax forms at any time prior to the end of the 6 month extension. (Youll still owe interest if you pay after the deadline). Keep in mind: An extension doesnt give you extra time to pay your taxes but it will keep you from getting a late filing penalty. Personal Tax Extension Form 4868 is for individual or joint taxpayers to apply for an additional 6 months to file IRS Form 1040, 1040A, 1040-EZ, 1040NR, 1040NR-EZ, 1040-PR or 1040-SS. It isnt possible to file a post-deadline extension. Tax Extension for personal income tax can be applied using Form 4868. If you know that you owe money to the IRS and can reasonably estimate how much you owe, you can avoid both the late payment penalty and late filing penalty by submitting Form 4868 and include a payment. IRS extensions for tax year 2021 must be filed on or before Apfor domestic taxpayers. Should I File Form 4868 Or Use The Automatic 2 Month Extension?Īs you read through the Form 4868 instructions, you may realize that it is easier to print, fill out, write a check, and mail in Form 4868 versus trying to figure out if you meet the automatic 2 month extension test.įurthermore there are two penalties involved here: Using the normal tax due date of April 15, the total time allowed to file your income tax return would be October 15. If you are out of the country, for example, and submit Form 4868, you may be applying for an additional 4 months. The phrase 6 more months is used to reconcile the fact that US citizens and resident aliens abroad are often given an automatic 2 months extension. How Long Is The Extension Using Form 4868?įorm 4868 is an application for an extension of time to file for 6 more months. You can use Form 4868 to request an extension of time to file the following forms:ġ040-SS. Form 4868 Is Used To Extend Which Income Tax Forms?

You should keep in mind, however, that the IRS can reject your request for an extension of time to file. You do not have to explain to the IRS why you are asking for the extension of time to file your income tax return. You can file without that information and later amend your income tax return which can get complicated.

Form 4868 (Tax Form, Instructions, Voucher)įorm 4868 is used for the purpose of avoiding the late filing penalty.įor example, your Form 1040 is almost complete but you are missing an important piece of information. The IRS can also impose a late payment penalty, see Form 4868 for more information. You do not have to submit a payment, however, interest will accumulate on any amount due to the IRS.

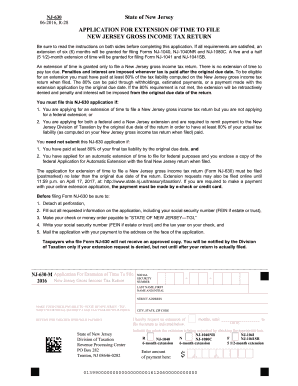

You are applying for an extension of time to file which must be made by the regular due date of your tax return to avoid the late filing fee. This printable PDF file contains the IRS 4868 tax form, instructions and payment voucher. Below is the PDF file link which you can download, print, and save.

0 kommentar(er)

0 kommentar(er)